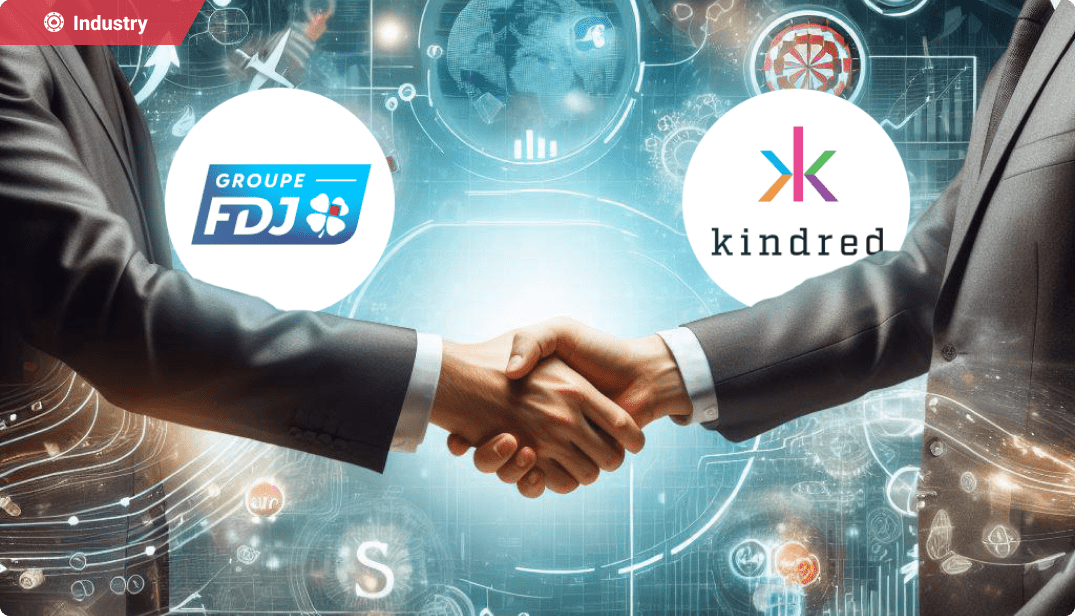

La Française des Jeux (FDJ) Has Offered $2.67BN to Acquire Kindred Group

Gambling empire Kindred Group could go under new ownership. Recently, it was reported that La Francaise de Jeux (FDJ) submitted a $2.67 bn offer to acquire the entire share capital of the popular online gambling operator.

It’s reported that the price FDJ offered is 24.4% higher than the shares at close for the final day of trading, which was on January 19. Currently, Kindred Group is recommending that shareholders accept the offer. The acceptance period is set to begin on February 20 and will be available until November 19, unless there are any further changes.

While this deal sounds like an amazing offer, it’s not 100% complete just yet. In order for the deal to go through, at least 90% of Kindred shareholders need to accept the offer. This offer could also be jeopardized if another party offers a higher proposal.

FDJ Aims To Boost The European Gaming Sector

So, what are FDJ’s plans with Kindred Group? Currently, the Kindred Group is an online gambling operator that’s responsible for nine online casino brands, such as 32Red and Unibet. This group offers a variety of online casino games and sports betting. If FDJ does acquire Kindred Group, they plan to create the second-largest operator in Europe’s gaming sector.

On top of this, FDJ believes this trade will provide value for the shareholders. They estimate that there will likely be more than a 10% accretion in dividends for each share. This will create a diversified and balanced profile.

If the trade goes through successfully, the boost in dividends will occur in 2025 and be paid out to shareholders in 2026.

Kindred Group is one of the leading operators in the gaming market. It’s known for top-of-the-line brands, attractive growth, high-end technology, and strong focus on responsible gambling. They have an excellent history of using strength and strategy in the market. FDJ believes they align with the core values of this group.

Does Kindred Group Support This Trade?

Nils Andén is the CEO of Kindred Group. He has spoken out positively about the proposal from FDJ and believes it could benefit both businesses. Andén also believes that FDJ has the financial and strategic capabilities to succeed with expanding the group.

In order to grow in its core markets, Kindred needs to think long-term. By trading to FDJ, they should have strong growth moving forward and regulating revenue.

Kindred Group first hinted at the possibility of a sale in 2022. At that point in time, they contacted multiple companies but were unsuccessful with an offer. After receiving no interest, the group launched a review of strategic alternatives. This would help the company evaluate options and provide shareholder value.

What To Expect From FDJ

Since news of the offer broke, FDJ has focused on expansion efforts. A big portion of their efforts is dedicated to digitizing core lottery and sports betting. This will provide more online options throughout Europe.

Kindred already has a market in Europe. But, under FDJ’s management, it will further expand its footprint. They also believe this will be a beneficial move for owners of sports betting platforms. Over 2023, sports betting and iGaming contributions from FDJ brands increased by 9.3%.

FDJ is the operator of France’s national lottery games. In 2023, they acquired other gambling brands to diversify the company and its offerings further. They closed a PLI deal in Q4 of 2023 to run the Irish National Lottery. They also acquired ZeTurf, a horse race betting operator.

The Financial Growth of Kindred Group

Recently, Kindred Group announced the preliminary results from the 2023 financial year. According to this update, the company earned a revenue of $1.54 bn. This is a 13.3% increase from the previous year.

They believe that the company is on the right track forward and has estimated growth for 2024. It’s expected that there will be a 12.4% growth in B2C activities and a 49.6% growth in B2B segment revenue. Overall, they estimate a 16.4% increase in gross profit.

But, with a growth in revenue also comes more expenses. It’s expected that the sales budget will increase by 9.5%. They also estimate an extra 16.8% increase in salaries.

This is all that Kindred has posted about their yearly results. They are expected to post their full-year and Q4 results sometime in February.

If the FDJ acquisition goes through, this could mean a considerable acceleration of revenue for Kindred. While things are still up in the air, it is looking positive. There are five shareholders of Kindred that account for 27.9% of the shares. They have agreed to support the offer. The official results of the offer will be released later in 2024.

Other news:

Snoop Dogg Dollars & Beyond: Alexandr Shavel on the Future of BGaming

CasinoRIX had the opportunity to speak with Alexandr Shavel, Product Owner at BGaming, following the launch of their newest slot, Snoop Dogg Dollars.

Amusnet Influencing the Future of iGaming: Insights from Yordan Georgiev

Yordan Georgiev, Amusnet’s Head of Casino Division and Deputy CPO, sat down with CasinoRIX to share the inspiration behind fan-favourite games, upcoming trends, and how Amusnet is pushing boundaries with creative re...

Driving Growth and Innovation: Exclusive Interview with Barb Tasci, Co-Founder and CBO of Revpanda

We're thrilled to sit down with Barb Tasci, the Co-Founder and Chief Business Officer of Revpanda, a trailblazer in digital marketing for the iGaming sector.

Stars Partners — a Full-Cycle Marketing Aggregator with Exclusive Offer Access and Deep Market Expertise

Stars Partners is an award-winning affiliate program offering high-converting brands with Betby’s sportsbook and AI-driven products. Partners enjoy flexible payouts (CPA, RevShare, Hybrid), global reach, 24/7 suppor...